Ever since we signed our contract of sale for the purchase of the block we have been trying to push to get our plans and building contract finalised. As soon as we knew that we were successful in purchasing our dream block we sent the Section 32 to Premier. We were hoping that it would be a short turn around to get the soil test done, the survey done and then our final contract price.

Well

unfortunately this was not the case. We can't just blame Premier however, but there seem to be a lot of bottle necks that we weren't aware of and had not been made aware of. These include:

- waiting for Melbourne Water to get back to the draftee with pit and easement locations

- waiting for Council to get back on flood overlays (see flood overlays below)

- trying to get a look in at contracts

- getting a site cost estimate

- a funeral for our sales consultant (apparently this takes four days out of our timeline).

First excuse for delay in issue of plans was "we are waiting for Melbourne Water."

Unfortunately we mixed this one up with one that we

accidentally managed to come across ourselves.

We are

currently in the middle of a decision of try sell the existing house or demolish. I got some early quotes for

demolition. Quote 1: $16k, Quote 2: $11k and last quote just over $10k. At least they were getting closer however we also thought to look into actually selling the existing house. Apparently you can, although it is a little harder with a brick veneer house.

As part of selling we looked into getting the trees on the nature strip removed. Her indoors called the council and after being put through to the usual suspects, planning and then building queries she got put through to Engineering Services. After a short

conversation with the extremely

helpful council engineer she was told all about tree removal. We ended up with a quote from

arborist for removal and

reinstatement of the two trees on the nature strip. Apparently $1.1k and $1.5k each. This was the good news however. During the

conversation with the very

helpful engineer he also said. Ah I see that your property is subject to flooding. "WHAT!!!"

During our one year adventure looking for property we had been very thorough. Always looking at

Land Data. Checking with the

hydrologists in my office etc. We had always been aware of flood risks etc. Now someone from the council was telling us about this. It wasn't in the Section 32. Out

conveyancor had not told us about it when we had her review our section 32. My friendly office hydrologist who had a full flood and drainage map of the area said there was no reason for concern. Now what. Apparently I had missed an important step during the purchasing process. I had called council. I had spoken to planning and asked them about the

property (even though I had already looked on Land Data). I had spoken to building. No one told me about "land subject to flooding." I had made the error of not asking for the third department to talk to: Engineering. Silly me.

Our very

helpful council engineer told us that once we have our final drawings and final contract we then need to submit these to council and then get them to determine the flood height. If all is OK we can go ahead. If not we need to raise our floor 300mm above the flood height. OK so how long does this take. "FOUR WEEKS." Now that is not fair.

So back to the list of delays. When speaking to our Premier Salesman and they told us about the Melbourne Water delay we thought that this related to flood height. No NO

NOOOO. We are still not there yet.

We just got an apologetic email from our

Premier Salesman stating that he was away for a funeral and that he will get us the latest drawings as soon as possible. At least we now have a new excuse for the end of last week. The previous ends of the previous weeks did not have such good excuses.

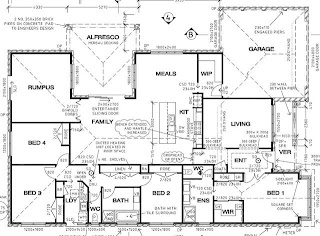

Her indoors had the idea of moving the oven to the centre of the over-all kitchen. This managed to give us a better drawer arrangement, instead of two very wide ones either side we could divide it into three.

Her indoors had the idea of moving the oven to the centre of the over-all kitchen. This managed to give us a better drawer arrangement, instead of two very wide ones either side we could divide it into three.

.jpg)